Statutory

Compliances

Management

Defends your organization from compliance trouble by managing all type of statutory compliances.

Statutory Compliances : Features

PF and ESIC

LWF and PT

TDS

Income Tax

PF and ESIC

Employee provident fund & ESIC

- Configure Employee PF limit.

- Generate PF challan.

- Generate Arrear PF challan.

- Generate ESIC challan.

- Auto generated FUV files.

- Generate all the challans company wise or branch wise.

LWF and PT

Labor welfare fund and professional tax

- Generate LWF Summary.

- Generate LWF return.

- Generate LWF challan.

- Slab wise Professional tax configurations.

TDS

Tax Deducted at Source

- Choose to run salary with or without TDS.

- Auto TDS calculation Through software

- Provision for TDS upload.

Income Tax

Income Tax

- Provision for Investment declarations request.

- Investment declaration verification and approval.

- Generate employee wise tax computation sheet.

- Analytical reports for quick views on employees status.

HR at Your Fingertips Smarter, Simpler & Savvier.

A Greener Tomorrow,

A Smarter Today with

Savvy HRMS

Savvy AI

Your Virtual Partner....

Savvy AI

Your Virtual Partner

Premium Add-Ons

Enhance your HRMS experience with these powerful integrations and services

Payroll Outsourcing

Complete payroll processing handled by our experts. Focus on your business while we manage compliance and calculations.

API Integration

Seamless integration with your existing systems. Connect third-party tools and create automated workflows.

AI Face Recognition

A smarter attendance system using face recognition with geo-fencing and anti-spoofing technology to prevent unauthorized access.

Compliance Ready

Stay updated with latest labor laws and regulations. Automatic compliance updates and statutory reports.

JV Integration

Integrate with your accounting software for seamless journal voucher and financial data synchronization.

WhatsApp/SMS Integration

Send notifications, payslips, and updates directly via WhatsApp/SMS for instant employee communication.

Multiple Login Options

SSO, Active Directory, 2FA, QR codes, and biometric login options for enhanced security and convenience.

AI Powered Email Triggers

Automated workflows and notifications based on events. Reduce manual work with intelligent automation.

Login-Free Approvals

Approve requests directly from Email, SMS and WhatsApp notifications without logging into the system.

Data Protection

Enhanced security measures including encryption, backup, and disaster recovery to keep your data safe.

Dojo Training

The Dojo Training Platform enables trainers to evaluate and track the skill matrix of workmen, ensuring the right people are assigned to the right tasks.

Employee Engagement

Rewards and recognition platform to engage and motivate employees. A suggestion box allows employees to share ideas for organizational improvement.

Your Login, Your Way

Access in a way that works best for you, whether you are in the office, at home, or on the go. Experience a simple, flexible, and secure connection to stay connected. You can manage everything you need without barriers or interruptions.

Have secure, seamless, and flexible access to your workspace from any connected device, all while maintaining control and convenience.

Client’s Testimonials

Praises

you can count

on...

Praises you can count on...

Mr. Gaurav Mathur

IT Manager

Mr. Neeraj

Manager-HR

Mr. Ramesh Vadaga

AVP - HR

Mr. Manoj Sharma

HR Head

Mr. Vijay

Sr. Manager - HR

Mr. Aditya Yadav

IT - Head

Mr. Sumer Seth

Director

Mr. Kamal Tiwari

HR

Mr. Sanjeev Bhatnagar

Manager-IT

Mr. Harish Bhandari

AGM HR

Mr. Praveen Gupta

HR Head

Mr. Vishal Pant

Manager-HR

Mr. Praveen Kumar

HR

Mr. Vineet Gupta

IT Head

Mr. Zaheer Khan

IT Head

Mr. Vineet Awasthi

Deputy Manager - HR

Mr. Bijender

HR Generalist

Mr. G.S. Saini

Sr. General Manager

Mr. Nirbhay Kumar Azad

Head IT

Mr. Nirbhay Kumar Azad

Manager - HR

Mr. Naveen Chaudhary

Head HR

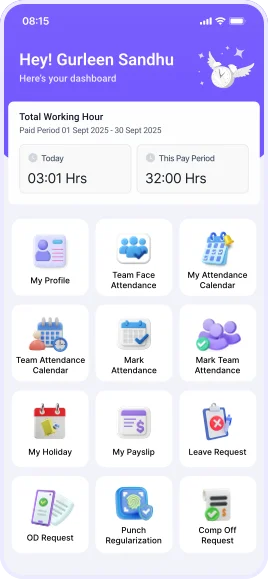

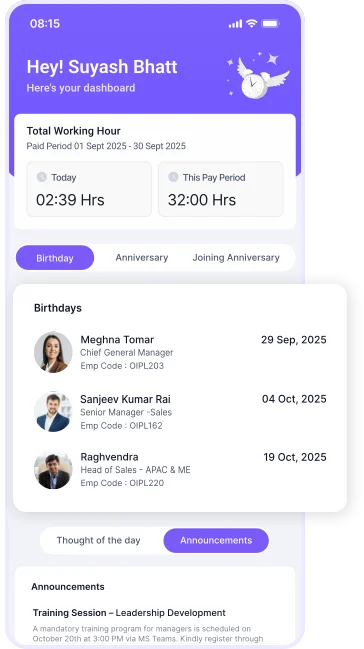

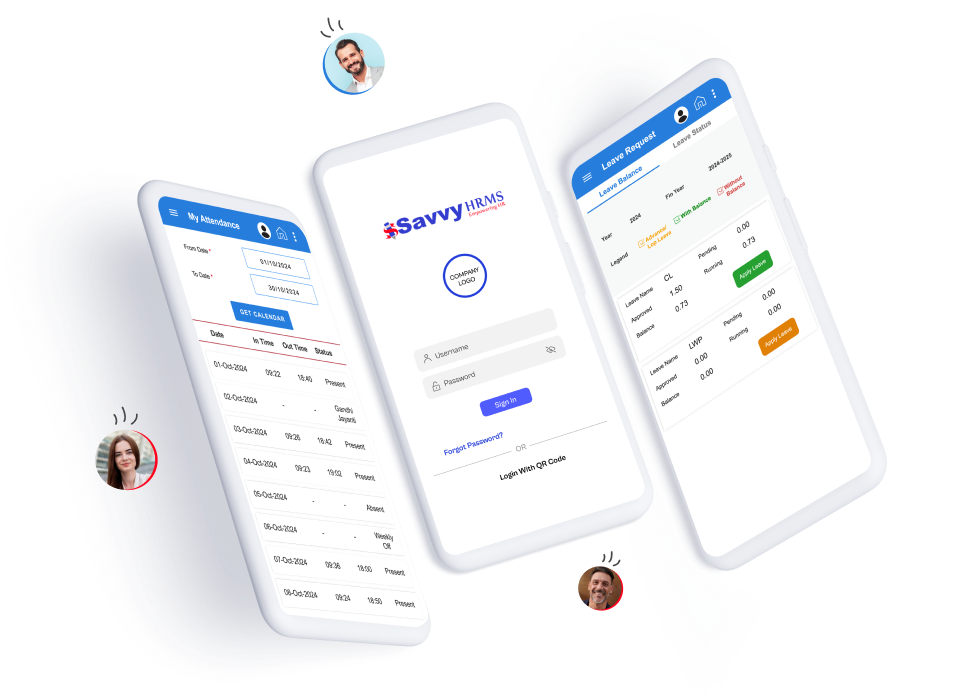

Empower your workplace

Savvy HRMS Mobile Application anytime, anywhere.

Frequently Asked Questions

Tax Management Software is a software used by a business. It performs automated tax calculation, filing, & reporting activities. Hence reducing the risk of noncompliance.

Tax Compliance Software ensures statutory compliance for business. On taxes like management of VAT, filing for professional tax. And compliance with income tax. It automates the tax returns generation of reports for audits.

Tax Automation Software works with payroll as well as tax systems. Which automatically calculate TDS, professional tax, and income tax. Thus reducing manual mistakes and increases the accuracy of finances.

This software enables an organization to do tax documentations and indirect tax calculations. Anytime, anywhere, and online filing. For global organizations, it supports multi-country features of tax software.

Tax Reporting Software generates complete reports for computation and filing of taxes. And Tax Audit Software, helps in compliance reviews. To ensure that businesses stick to the tax laws so as not to incur penalties.

Tax Planning Software gives business insights for optimizing corporate taxes & sales tax deductions. And investment declarations, hence reducing tax burden for businesses.

Yes, there are many affordable tax software programs. According to the needs of small or new businesses, including Savvy HRMS Tax Filing Software, which provides automated compliance solution at a reasonable price.